EVs for public transportation still in shadow

The Nepal Weekly

The Nepal Weekly  June 4, 2024

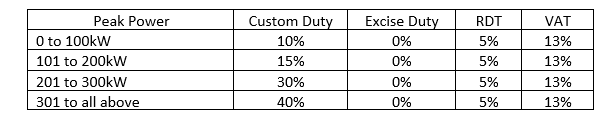

June 4, 2024Finance Minister of Nepal Government Barsha Man Pun had presented the budget of the country for fiscal year 2081-02 (16 July 2024- 15 July 2025). He had mentioned that tax on import of electric vehicles have been revised. Minister Pun, on Tuesday 23rd May, presented a budget of Rs 1.86 trillion for the fiscal year 2081/82.

As per the announcement, electric vehicles are to be dearer by at least 10 percent according to the motor power of the vehicle.

The government through the annual budget for the next fiscal year has revised the rates of customs duty and excise duty on the import of EVs. That means, So, the more powerful the electric vehicle, the higher the tax rates it will incur. For EVs with a motor power of 50kW, there’s a duty of 10% and no excise duty. EVs with a motor power of 100kW will face a duty of 15% and an excise duty of 5%, vehicles with a motor power of 200kW will be subject to a duty of 20% and an excise duty of 15%. If the motor power is 300KW, the duty is 40% and the excise duty is 35%. Similarly, for EVs with a motor power above 300kW, the duty is 60% and the excise duty is 50%.

The changed scenario:

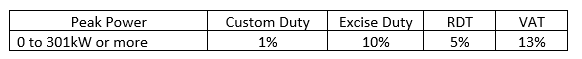

It is worth to recall that the budget of the Fiscal Year2016 -17 was an ‘opening of a big door’ for the electric vehicles to import. Then the ‘new rule’ allowed a total of 28% taxes for importing electric vehicles against a 248% for fossil fuel vehicles excluding public transportation vehicles. That was as stated below.

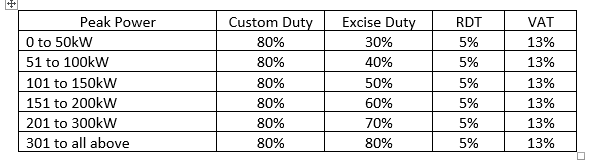

On the contrary, the budget of 2020-21 changed tax rule making electric vehicles highly expensive. As a result, imports and users stayed away from thinking of electric vehicles.

The slight relaxing of tax rule in the October the same year could not make any workable difference.

Around 4 months later, in October, the tax rate was revised but the workout did not make difference in the EV market.

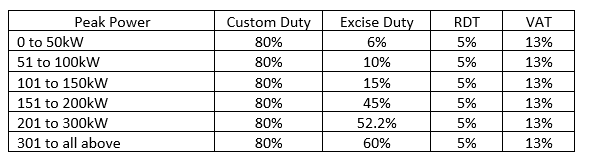

The budget of 2021-22 has again brought out comfortable rules, which appears to be almost similar to the tax rule applied earlier in 2016-17. This made electric vehicle market speedy again.

Moreover, electric transportation in Nepal may be categorized as (1) Cable car, ropeway, electric train, metro, monorail, (2) bus, mini bus, micro bus, (3) mini car, car, sedan, van, SUV, crossover, (3) three wheelers, (4) two wheelers and (5) electric bicycles.

Notably, the budget every time has been much focused on electricity driven mini car, car, sedan, van, SUV, crossovers. Actually, the government policy should be more attentive to make EVs for public transportation with the first priority. Funding for such important and needful arrangements should be a priority. Likewise, infrastructure for this segment should be taken into consideration so as large number of population could use buses, mini buses driven by electricity. Similarly, legal provisions for electric vehicles for taxi cars and ride sharing like rental service should be made user and operator friendly. Part of Pollution Control Fund, the tax taken on every litre of petrol and diesel has been near about NRs 30 billion by this time might be utilized to promote electric public transportation system in the country, special extending to the public transportation. (By R.P. Narayan)